Credit card compound interest calculator

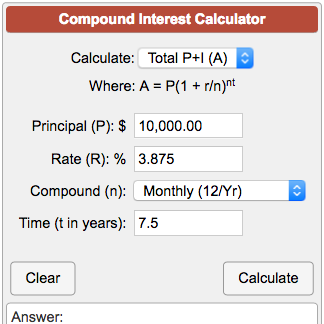

Learning the compound interest formula is key to understanding your savings potential. The Compound Interest Calculator below can be used to compare or convert the interest rates of different compounding periods.

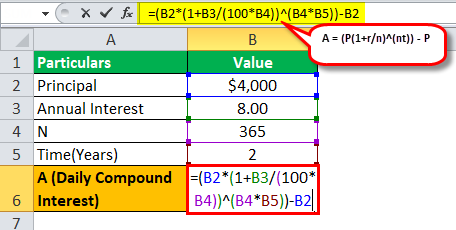

Daily Compound Interest Formula Step By Step Examples Calculation

Credit card APRs average about 20 which is relatively high for any loan.

. The Federal Reserve keeps tabs on the average interest rate that US. Pay off your credit card. Enter the bank interest rate in percentage.

If youre forced to maintain several debts at once youll get to zero sooner by making a large lump-sum payment toward a single balance each month rather. In May 2022 the average credit card. What you need to know to make it work for you.

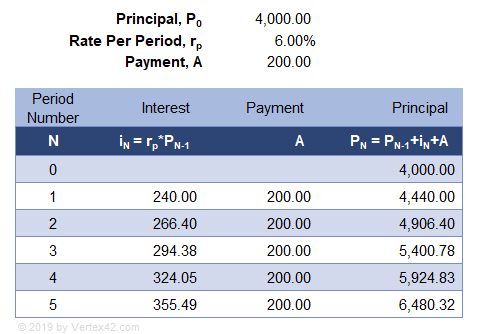

Informationtooltips for calculator. Credit card companies use compound interest which is the interest charged on the outstanding balance plus interest already accrued. The interest rate you owe on balances transferred from loans or other credit cards to the applicable credit card.

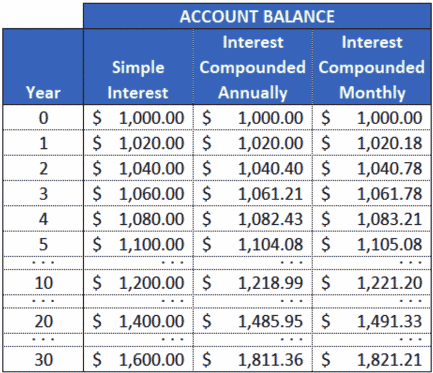

Small differences in savings or CD rates may seem trivial. So the way to find out how much your balance grows each day is to take your annual interest rate 17 and divide it by the number of days in a year. Cancel a credit card.

To begin your calculation take your daily interest. Calculate its simple interest and compound interest. Balance Transfer APR.

How to compare credit cards and get the best deal. It will also show you how much you will pay in interest and fees. Retirement Mortgage Credit Card Debt Payoff Auto Loan Savings Investment Loan Personal Finance Compound Interest Calculator Debt Snowball Calculator.

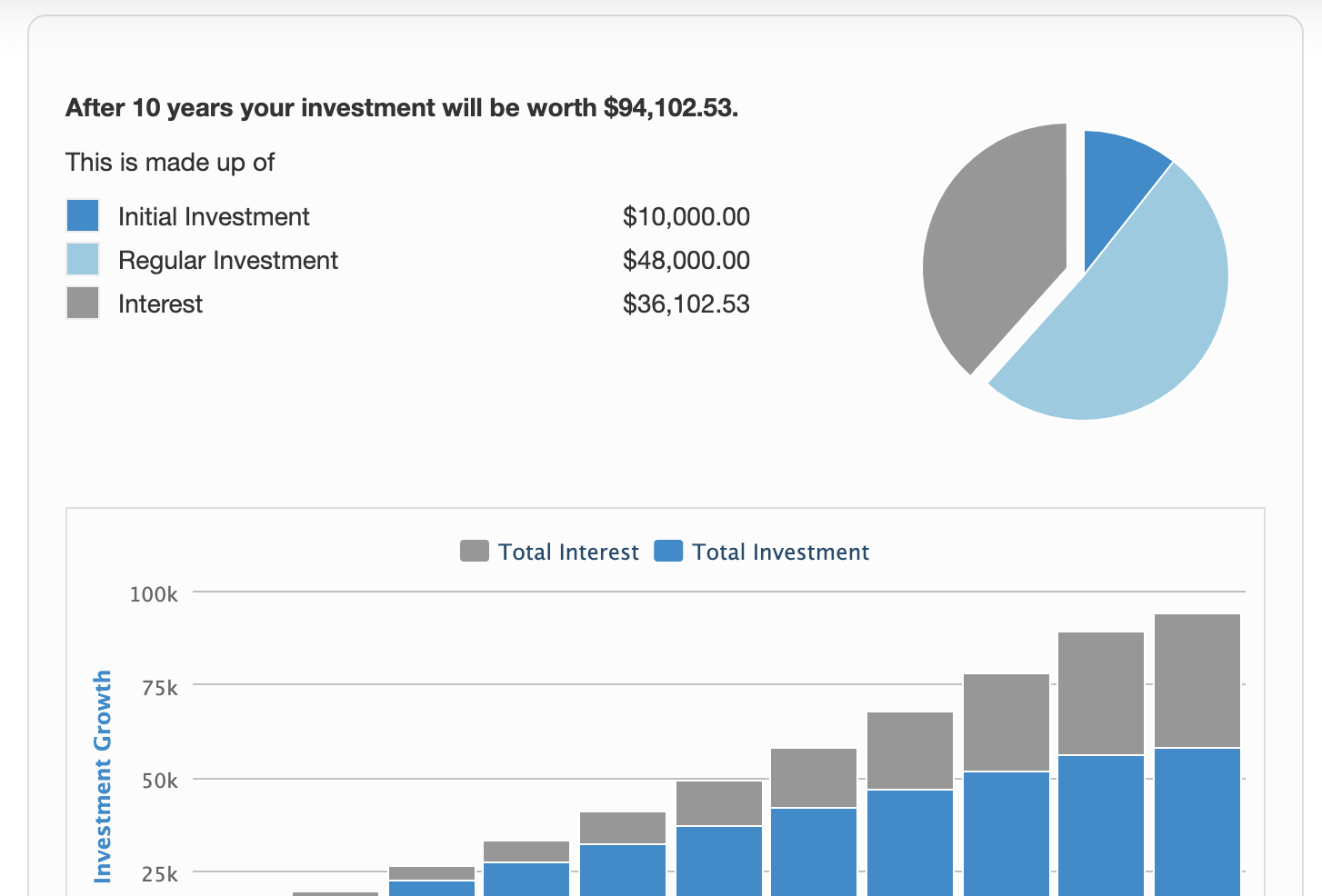

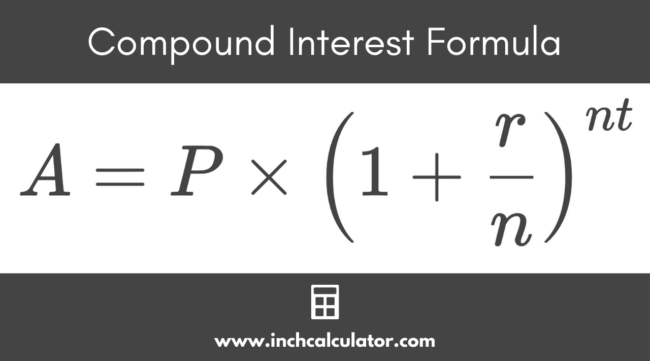

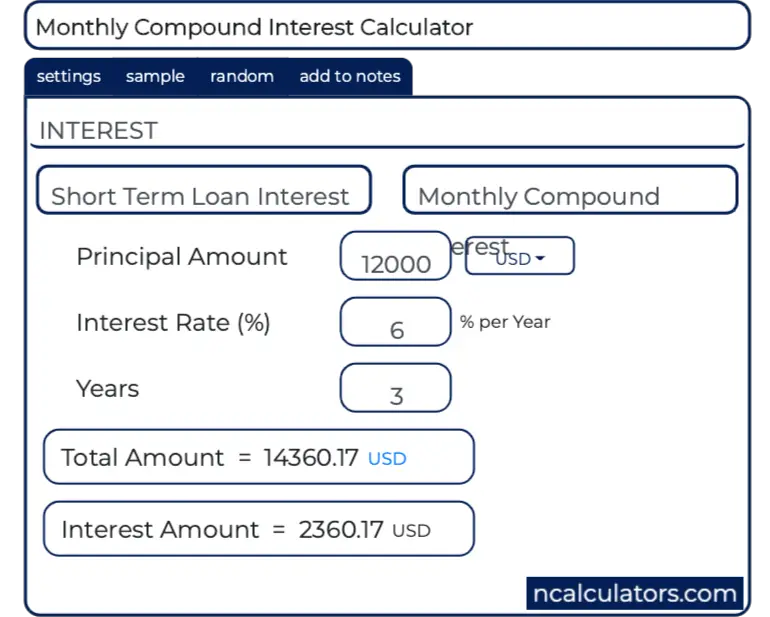

According to Discover Card credit card interest is often compounded daily. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. A P1 rn nt.

Also an interest rate compounded more frequently tends to appear lower. Compound Interest is calculated on the principal amount and also on the interest of previous periods. Some credit card issuers will compound interest daily while others do it monthly.

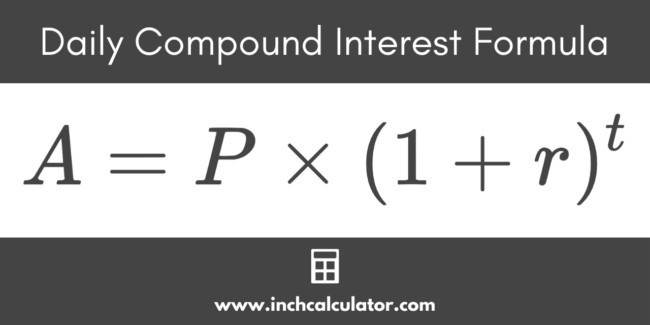

How to calculate daily compound interest. Mortgage loans home equity loans and credit card accounts usually compound monthly. View the principle and total amount by year in the chart and table.

Compound interest is used more popularly in our real life like credit card saving and checking account and mortgage loan. Where A final amount including interest P principal amount r annual interest rate as decimal n number of compounds per. This is the interest rate youre charged on.

But earning more in your savings and CD accounts can lead to much larger account balances balances over time when you examine the difference in compound interest over time. This credit card interest calculator figures how much of your monthly payment goes to interest vs. Enter the initial deposit amount.

This is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade. Check out The Ascents best credit cards for 2022. Lets say that you owe 500 on your credit card and your credit card comes with a 17 interest rate.

Weekly Rate Updates. The following formula can be used to find out the compound interest. Use our Credit Card Interest Calculator.

News World Report and more. Your outstanding balance will grow exponentially faster if the company. Her favorite topics include maximizing credit card rewards and budgeting.

Compound interest can make carrying a credit card balance even worse because it adds up over time and is added to your existing debt. How to cancel your card the right way. Jun 30 2021.

Credit Card Travel Guide. Use these credit card repayment calculators to work out effective strategies to pay off your credit card debt. Credit Card Dining Guide.

Calculate how long it will take to pay off your credit card balanceAlternatively use the second calculator to work out how much you should pay each month to eliminate your credit card balance completely in a set period of time. A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. Credit card balance transfers.

This credit card payoff calculator is intended solely for general informational and educational purposes. An online compound interest calculator can help you crunch the numbers but you can also do the math yourself. Enter the deposit period in months.

This is the amount you owe on your credit card. For this reason lenders often like to present interest. Interest rates on credit card and other debts tend to be high which means that the amount.

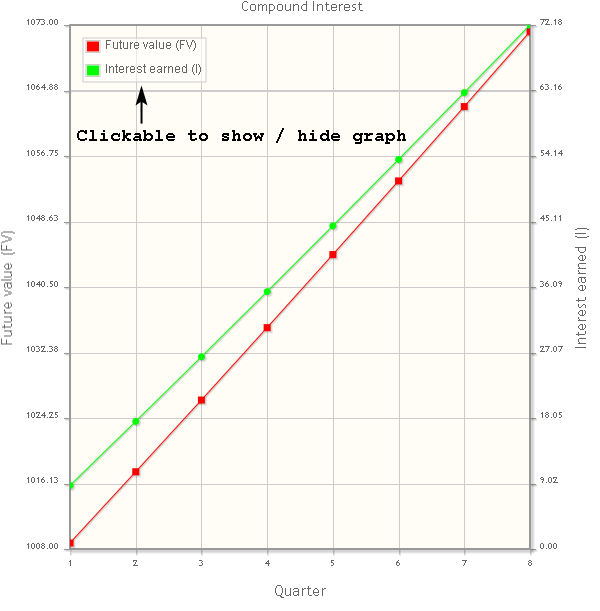

That means it will actually multiply each days average daily balance by the accounts daily periodic rate and then add that amount to the next days average daily balance. For example 10000 at 8 annual interest rate compounded annually for 10 years. Unless a credit card has a zero or low introductory APR interest on the balance is quite high.

Principal total interest cost months to payoff and more. Two women sitting together at. Consolidating multiple credit card debts into a single lower-interest account is always preferable to having several active balances with separate terms billing cycles and interest rates.

Most credit card issuers will compound an accounts interest charges daily. Heres the equation for calculating compound interest. Consumers pay for a variety of different financial productscredit cards included.

Simple ways to keep on top of your credit card. For most cards you begin with a low rate even 0 for a. This balance transfer credit card calculator examines up to 5 cards and calculates when the debt will be paid off.

Credit card interest rate APR Tooltip. The savings shown in your results are based on the difference in total compound interest charges between the higher APR cards you entered and the lower promotional balance transfer APR net of transfer fees. Compound Interest Calculator.

Daily compound interest is calculated using a simplified version of the formula for compound interest. Choosing a credit card. Good APRs average about 8-12 though it is possible for someone with excellent credit to get even lower rates.

Compound Interest Calculator Crown Org

Walletburst Compound Interest Calculator With Monthly Contributions

Simple Vs Compound Interest Definitions And Calculators Quicken

Mobilefish Com Compound Interest Calculator With Graph

Compound Interest Calculator Inch Calculator

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator For Excel

Compound Interest Calculator With Formula

Daily Compound Interest Calculator Inch Calculator

Compound Interest Definition Formula How It S Calculated

How Can I Calculate Compounding Interest On A Loan In Excel

Monthly Compound Interest Calculator

Compound Interest Formula And Compound Interest Financial Quotes Learning Math

Compound Interest Calculator Credit Karma

Compound Interest Calculator For Excel

Credit Card Interest Calculator Find Your Payoff Date Total Interest

Calculator For Interest Online 54 Off Www Wtashows Com